Oklahoma Film Incentives

HB1716 and HB2793 [pending 2006] (68 OS §2357.101)

25% income tax credit on reinvested film/music profits

No limit, except income tax liability

No appropriation required from legislature

No carryover (reinvest prior to year end)

Administrative Rules will be posted here when available

Oklahoma Film/Music Rebate Program 15%

HB1547, pages 57 – 59 (68 OS §3624)

15% cash rebate, sliding scale based on resident crew percentage *

Paid July following income tax filing

$2M film production budget; $1.25 Oklahoma expenditures

$5M annual rebate fund

50% Oklahoma resident crew

Distribution contract required

* 15% (100-50%); 10% (40-25%); 5% (25-0%)

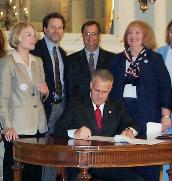

Winchester, Speaker Pro-Tem (left) and D-Sen.

Debbe Leftwich (right) creating the 25% Film &

Music Reinvestment credit. Authored by Paul

Tompkins and Fred Imel, CPA of CrazyFish

Films (middle left/right) and effective

immediately, the bill promotes motion pictures

which reinvest profits into other Oklahoma

projects. Gov. Brad Henry signs the important

legislation.

plans with Oklahoma Gov. Brad Henry.

| | ||

405-924-3220

[email protected]